SIP is when we invest a fixed amount in a mutual fund at a fixed time (usually a month). The SIP amount is deducted from your bank account through automatic debit. But what if you miss a SIP installment?

When we first start a SIP (Systematic Investment Plan), investing money in SIP is very easy and safe. But suppose you miss one of your SIP installments due to some reason or due to lack of money in the bank, what will you do then? So let us know what options are available to you even if you miss any installment of your SIP. And how can you pay for it?

What happens if you miss a SIP installment?

- No penalty from mutual fund houses:

- If you miss one or two installments, the mutual fund company does not charge you any penalty.

- Your existing investments will not be affected, and they will continue to generate returns.

- But remember, the amount you miss can affect the growth of your investment.

- The bank may levy a penalty:

- If there is insufficient money in your bank account and the automatic mandate fails, the bank will charge you a penalty.

- Bank penalty can range from Rs 100 to Rs 750, and the rate depends on the bank.

- For example, if your bank charges Rs 500 per missed installment, and you have three SIPs, you may have to pay a penalty of Rs 1,500!

- SIP will be canceled if you miss three consecutive installments:

- If you do not pay installments for three consecutive months, the mutual fund company may cancel your SIP.

- After that, you will have to start a new SIP again, which can lead to a loss of time and money.

- Impact on investment:

- The main advantage of SIP is that you can buy units at a lower rate when the market is fluctuating.

- But if you miss an installment, you lose that opportunity, which can reduce your long-term returns.

Want to Invest? Earn Lakhs with SIP in IndusInd Bank

How to pay missed SIP installment?

There is no need to panic if you miss an installment. I have found some simple steps that can help you:

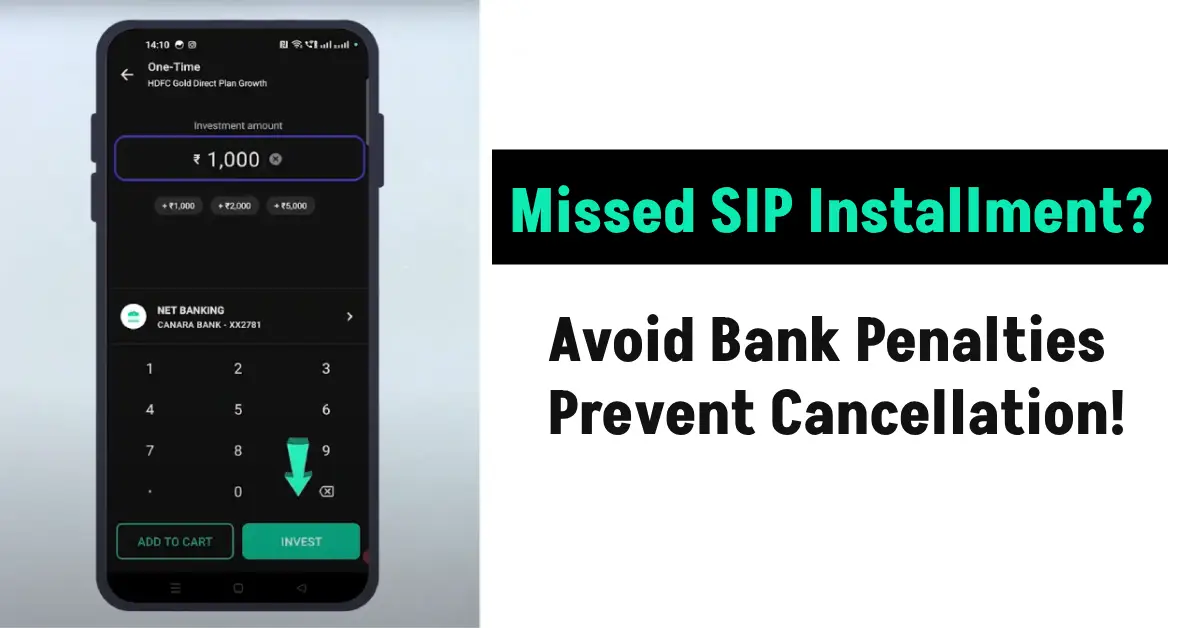

- Invest money in lump sums:

- If you have missed one or two installments, you can invest that money in lump sums.

- For example, if your monthly installment is Rs 2,000, you can deposit Rs 2,000 in your bank account before the next SIP date and invest it.

- Contact the fund house:

- Contact your mutual fund company and inquire about the missed installment.

- Some companies allow you to pay the installment directly. You can call your Mutual Fund Customer Care, and they will provide you with the option of online payment.

- Restart the SIP:

- If your SIP has been canceled, start a new SIP again. You will need to update your bank account mandate for this.

Investing in Mutual Funds: List of Top 10 mutual funds for SIP

How to avoid missing installments?

- Pause SIP:

- If you already know that you will not have enough money in the coming month, then opt for the option to pause the SIP.

- Pausing SIP can be approved in 7 to 25 days, so plan. I paused one of my SIPs for 15 days and avoided the penalty.

- Check bank balance:

- Make sure that there is enough money in your bank account before the SIP date.

- Change dates:

- Align your SIP installment date with your salary date so that the money is available. I made mine the day after my salary, and now I never have any problems.

Answers to some important questions

- Will my credit score be affected?

- No, missing SIP installments will not affect your credit score, as SIPs are not loans. I had asked the bank about this, and they said it does not affect your credit.

- What can I do if I miss some SIP installments?

- You can invest the money in lump sums or pause the SIP and continue. I invested Rs 5,000 for my missed installments in one go, and my target remained on track.

- What is the process of pausing an SIP?

- Go to your mutual fund app or website, select the ‘Pause SIP’ option, and make a request 30 days in advance.

So, if you ever miss a SIP installment in the future, there is no need to panic. Because now you know what to do and how to save yourself from the penalty. So, if you liked this post, then definitely share it. And if you have any questions, you can ask me.