Trading Journal : PDF and Excel Free Downloads

Welcome, aspiring trader, to the cornerstone of your financial success – your Trading Journal. This book isn’t filled with magic formulas or overnight riches; it’s your personal companion on the path to mastering the market.

The market is a complex beast, and navigating its ever-shifting terrain requires discipline, reflection, and continuous learning. This journal will be your training ground, your record of triumphs and tribulations, and ultimately, the key to unlocking your full trading potential.

Why a Trading Journal?

Imagine embarking on a journey without a map or compass. Trading without a journal is like that – a recipe for confusion and missed opportunities.

Your Trading Journal is your:

- Memory Bank: Capture the details of every trade, from entry and exit points to the emotions driving your decisions.

- Learning Platform: Analyze past trades, identify patterns, and learn from both successes and failures.

- Performance Tracker: Monitor your progress, quantify your results, and identify areas for improvement.

- Trading Compass: Over time, your journal will guide you towards developing a winning trading strategy.

Many successful traders credit their meticulous journaling habits for their achievements. Now, it’s your turn to unlock the power of self-reflection and analysis.

Key disciplines day traders should follow every single day

Here are some key disciplines:

Pre-Market Routine:

- Develop a Trading Plan: Before entering the market, have a clear plan outlining your entry and exit points, risk management strategies, and target profits.

- Market Research: Stay informed about current events, economic indicators, and news that could impact the market you’re trading. Research company earnings reports and analyze technical charts.

- Mental Preparation: Get into the right headspace. Focus, be calm, and avoid emotional trading decisions.

Trading Discipline:

- Stick to Your Plan: Don’t deviate from your pre-determined strategy due to emotions or market fluctuations.

- Risk Management: Always use stop-loss orders to limit potential losses on each trade.

- Discipline of Money Management: Allocate a specific amount of capital for trading and stick to it. Don’t chase losses or risk more than you can afford.

- Discipline of Time Management: Set realistic goals for your trading sessions and avoid getting caught up in the heat of the moment. Take breaks to maintain focus.

Post-Market Analysis:

- Review Your Trades: Analyze your performance throughout the day. Identify successful trades and pinpoint mistakes.

- Journaling: Record your trades, decisions, and thought processes in your trading journal.

- Learning & Improvement: Review your analysis and identify areas for improvement in your trading strategy.

Additional Points:

- Discipline of Emotions: Control your emotions and avoid making impulsive decisions based on fear or greed.

- Discipline of Patience: Don’t force trades. Wait for the right opportunities that align with your strategy.

- Discipline of Continuous Learning: The market is dynamic. Stay updated with new trading strategies and market trends.

Read Also: Top 10 Mutual Funds for SIP to Invest

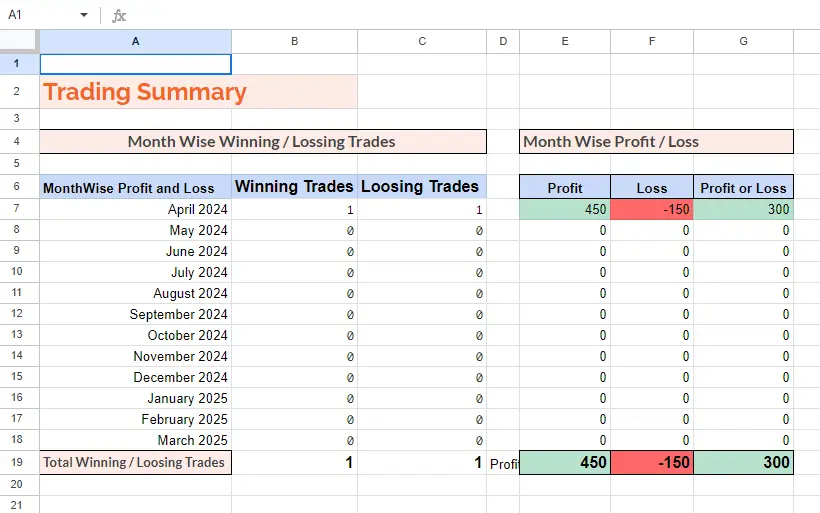

Download: Free Trading Journal Template PDF

Download: Free Trading Journal EXCEL Template

FAQ’s for Why Trading Journal is Important?

What is a Trading Journal and Why is it Important?

A trading journal is a personal record of your trading activity. It serves as a powerful tool for reflection, analysis, and ultimately, improvement in your trading skills. By meticulously recording your trades, decisions, and thought processes, you gain valuable insights into your strengths and weaknesses as a trader.

What Should I Include in My Trading Journal?

Each journal entry should ideally include the following:

- Date: Track your progress over time.

- Pre-Market Analysis: Briefly outline market conditions, news that might impact your trades, and your planned strategy.

- Trading Activity: Record details of each trade, including entry and exit points, quantities, and the rationale behind your decisions.

- Post-Trade Analysis: Evaluate your performance. Analyze both winning and losing trades, identifying your successes and pinpointing areas for improvement. Reflect on emotions that may have influenced your decisions.

How Often Should I Review My Trading Journal?

Regularly reviewing your journal is crucial for maximizing its benefits. Aim for daily reviews after each session, and consider more in-depth analysis at the end of each week or month.

Will a Trading Journal Guarantee Success in the Market?

While a trading journal won’t guarantee instant riches, it’s a powerful tool that can significantly improve your trading skills over time. By fostering self-reflection and analysis, it allows you to learn from your mistakes, refine your strategy, and develop a more disciplined approach to trading.

I’m New to Trading. Do I Need a Trading Journal?

Absolutely! Starting a trading journal from the very beginning is one of the best practices for new traders. It helps you develop a structured approach to trading and instills the habit of self-awareness and analysis, both essential for success in the market.

How Can I Use My Trading Journal to Improve My Trading Strategy?

Over time, your trading journal becomes a valuable data source. Use it to identify patterns in your wins and losses. Analyze your performance under different market conditions and adjust your strategy accordingly. This iterative process of learning and adaptation is key to becoming a consistently profitable trader.

Remember, a trading journal is a personal tool. Customize it to fit your needs and preferences. With dedication and consistent use, your trading journal can become your secret weapon in navigating the dynamic world of the stock market.

I like this web blog so much, saved to favorites.

hi!,I like your writing very a lot! proportion we keep in touch extra about your article on AOL? I need an expert in this space to resolve my problem. May be that’s you! Having a look ahead to look you.

I really like gathering utile information , this post has got me even more info! .

Simply desire to say your article is as astonishing.

The clearness on your post is just excellent and i can think you’re an expert in this subject.

Fine together with your permission let me to snatch your RSS feed to stay up to date with coming near near post.

Thank you one million and please carry on the gratifying work.

I think this is one of the most significant info for me.

And i am glad reading your article. But wanna remark on few general things, The site style is wonderful, the articles is really great : D.

Good job, cheers

I know this if off topic but I’m looking into starting my own weblog and was curious what all is needed to get setup? I’m assuming having a blog like yours would cost a pretty penny? I’m not very web smart so I’m not 100 sure. Any recommendations or advice would be greatly appreciated. Appreciate it

Enjoyed examining this, very good stuff, thankyou. “All of our dreams can come true — if we have the courage to pursue them.” by Walt Disney.

Regards for this post, I am a big fan of this site would like to go on updated.

I really enjoy examining on this website, it contains fantastic posts. “One should die proudly when it is no longer possible to live proudly.” by Friedrich Wilhelm Nietzsche.

hi!,I really like your writing so so much! share we be in contact more approximately your article on AOL? I need an expert in this area to resolve my problem. May be that is you! Having a look forward to see you.

I?¦ve learn a few good stuff here. Definitely value bookmarking for revisiting. I surprise how a lot attempt you set to make any such wonderful informative site.

The heart of your writing whilst appearing agreeable initially, did not settle well with me personally after some time. Someplace throughout the paragraphs you were able to make me a believer but only for a short while. I however have got a problem with your leaps in logic and one would do nicely to help fill in all those breaks. If you can accomplish that, I could surely be amazed.

Hey! I know this is kind of off topic but I was wondering which blog platform

are you using for this site? I’m getting fed up

of WordPress because I’ve had problems with hackers and I’m looking at alternatives for

another platform. I would be great if you could point me in the direction of a good platform.

I am too using WordPress

Thanks for all your efforts that you have put in this. very interesting information.

Thank you so much for your support! I’m glad you found the information interesting. Stay tuned for more! 😊

Hi, of course this paragraph is really fastidious and I have learned lot of things from it on the topic of blogging.

thanks.

I’m thrilled you found the paragraph helpful! Thanks for your kind words and for learning along with me. 😊

I cling on to listening to the newscast speak about getting boundless online grant applications so I have been looking around for the best site to get one. Could you advise me please, where could i find some?

Thank you for reaching out! I’d recommend checking out [specific resource or site] for online grant applications. Let me know if you need further assistance! 😊

Wohh just what I was looking for, appreciate it for posting.

I’m so glad it was helpful! Thanks for stopping by and leaving such a kind comment. 😊

Thanks for sharing with us this important Content. I feel strongly about it and really enjoyed learning more about this topic.

I looked up most of your posts. This post is probably where I think the most useful information was obtained. Thank you for posting. You probably be able to see more.

I simply could not go away your web site before suggesting that I extremely loved the usual information an individual provide in your guests? Is gonna be back continuously to check up on new posts