ROI Calculator Investment: evaluate returns on investments

ROI Calculator Investment: Return on investment calculator, is a useful tool that helps businesses determine the profitability of an investment. It calculates the return on investment by comparing the gains or benefits of an investment to its cost.

ROI Calculator

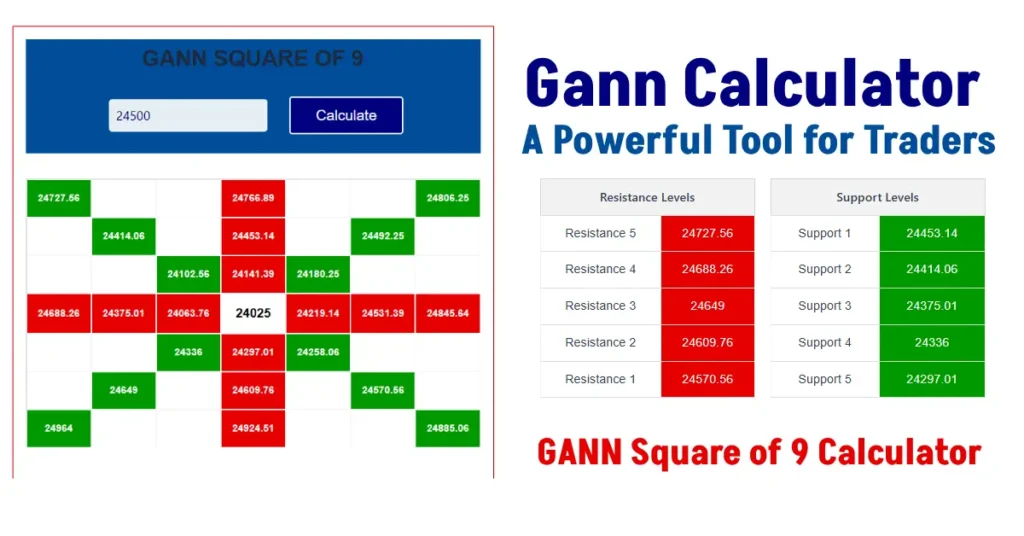

TCheck this Also: The Gann Calculator

How to Use and How Useful

How to Use the ROI Calculator

- Select Currency:

- Choose a currency from the dropdown (default: ₹ INR for Indian users).

- Options include USD ($), EUR (€), and GBP (£) for international users.

- Enter Inputs:

- Amount Invested: Input the initial investment (e.g., ₹10,00,000).

- Amount Returned: Input the total amount received (e.g., ₹12,00,000).

- Investment Time: Input the duration in years (e.g., 2).

- All inputs require positive numbers; time must be at least 1 year.

- Calculate ROI:

- Click the Calculate button to compute:

- Absolute ROI: Total percentage return on investment.

- Annualized ROI: Average annual return, accounting for compounding.

- Gain/Loss: Difference between return and investment.

- Break-even ROI: Reference point (0%) for comparison.

- Yearly Breakdown: Table showing projected returns per year based on annualized ROI.

- Click the Calculate button to compute:

- Reset Inputs:

- Click the Reset button to clear all inputs, reset currency to ₹, and clear results.

- Interpret Results:

- View the results in the green result box, formatted in the selected currency (e.g., ₹12,34,567.00).

- Check the yearly breakdown table to understand growth over time.

- Error Handling:

- If inputs are invalid (e.g., negative investment, zero time), an error message appears (e.g., “Please enter a positive investment amount.”).

Calculate Income Tax in Simple Steps: Income Tax 2025-2026

How Useful the ROI Calculator Is

- Investor Decision-Making: Helps Indian investors (e.g., in stocks, mutual funds, real estate) evaluate returns on investments like SIPs or fixed deposits.

- Financial Planning: Assists users in planning long-term investments by projecting yearly growth.

- Educational Tool: Educates novice investors on ROI concepts via tooltips and clear results.

- Comparison with Break-even: Shows whether an investment outperforms the break-even point (0% ROI). Helps users identify loss-making investments (negative ROI) or minimal returns.

- Currency Flexibility: Supports Indian Rupees (₹) for local users and other currencies for NRIs or international visitors.