Download Form 26AS: Form 26AS is a tax credit statement, which is obtained from the Income Tax Department. This is a kind of annual statement that contains a record of all the tax-related information related to your PAN (Permanent Account Number). That is, the tax deducted from your income (TDS – Tax Deducted at Source), the tax collected (TCS – Tax Collected at Source), the advance tax or self-assessment tax that you have paid yourself, and the high-value transactions (like property purchases, mutual funds). A friend of mine told me that this form is like your ‘tax passbook’, which allows you to see all your tax-related things in one place.

Form 26AS contains the following information:

- TDS deducted from your salary, interest, rent, or other income.

- Advance tax or self-assessment tax paid by you.

- Refund received by you (if any).

- High-value transactions like property purchases, mutual funds, or foreign remittances.

- Your business turnover details from GSTR-3B (if you are GST registered).

Download Form 26AS: Step-by-step guide

Method 1: Download from the Income Tax Department website

Step 1: Go to the Income Tax Portal

Open the website www.incometax.gov.in/iec/foportal/ in your browser. This is the official website of the Income Tax Department.

Step 2: Login

Once you are on the website, you will see the ‘Login’ option at the top right corner. Click there. Enter your User ID – it can be your PAN number or Aadhaar number. Then enter your password and click on ‘Continue’. If you are logging in for the first time, then click on ‘Register’ and register first – for this you will have to enter your PAN, name, date of birth, and mobile number.

Step 3: Go to the e-File section

After logging in, you will see a dashboard. There you will see the option ‘e-File’ at the top. Click on it. Then select ‘Income Tax Returns’ from the drop-down menu, and then click on ‘View Form 26AS’.

Check out this: 4 Wealth Making Options Will Beat Fixed Deposit (FD) Returns!

Step 4: You will be redirected to the TRACES website

After clicking on ‘View Form 26AS’, you will see a disclaimer. Click on ‘Confirm’ there. Then you will be redirected to the TRACES (TDS Reconciliation Analysis and Correction Enabling System) website.

Step 5: Accept Disclaimer

After visiting the TRACES website, a checkbox will appear where you have to accept the disclaimer regarding the use of Form 16/16A. Tick the checkbox there and click on ‘Proceed’.

Step 6: Select Form 26AS

Now you will have to click on ‘View Tax Credit (Form 26AS)’ option will appear. Click on it.

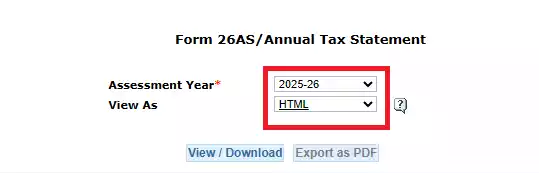

Step 7: Select Assessment Year and Format

Now select the Assessment Year for which you want to view Form 26AS. For example, if you want to view the form of 2024-25, select it. Then select the format from ‘View As’ – if you want to view it online, select ‘HTML’, and if you want to download, select ‘PDF’.

Step 8: Download

After selecting the format, you will have to enter a verification code. Enter it and click on ‘View/Download’. If you have selected PDF, the form will be downloaded to your device. My friend said that now there is no need to enter a password for PDF, but for some older versions, your date of birth (in DDMMYYYY format) may be the password – for example, if your date of birth is 15 August 1990, the password will be 15081990.

Did you know this: Employees Deposit Linked Insurance Scheme!

Method 2: Download Form 26AS via Net Banking

Step 1: Go to the official website of your bank, and log in to net banking.

Step 2: Find the option ‘Tax Services’ or ‘Tax Credit’ (this option may vary across banks – for example, in SBI it is under ‘My Certificates’ under ‘e-Services’, while in HDFC it is under ‘Enquire’ under ‘View Tax Credit Statement’).

Step 3: Click on ‘View Form 26AS’, and select the assessment year.

Step 4: Download the form or view it online.

Some banks that offer the facility to view Form 26AS through net banking include SBI, HDFC, ICICI, Axis Bank, and Citibank. This facility is completely free.

Different parts of Form 26AS

Form 26AS has several parts, and each part contains different information. It took me a while to figure it out, but once I understood it, it was very easy:

- Part A: This contains information about the TDS deducted from your salary, interest, or other income. The name of the deductor, TAN (Tax Deduction Account Number), and how much tax was deducted, all appear here.

- Part A1: If you have filed Form 15G or 15H (to avoid TDS deduction), then that information appears here.

- Part B: This contains information about TCS (Tax Collected at Source) – like if you have purchased certain items (e.g. liquor, parking lot), then the tax collected from there appears here.

- Part C: This contains information about taxes you have paid apart from TDS and TCS – like advance tax or self-assessment tax.

- Part D: If you have received a refund, its information appears here – like the refund amount, date, and mode of payment.

- Part E: This contains information about high-value transactions – like property purchases, mutual funds, or shares.

- Part F: This contains information about TDS deducted on property purchase and sale, rent, or payments to contractors/professionals.

- Part G: This shows defaults (errors) in TDS, but the demands raised by the Assessing Officer are not shown here.

- Part H: If you are GST registered, then the turnover information from your GSTR-3B is shown here.

Why is Form 26AS important?

- Verifying Tax Deduction: You can check whether the TDS deducted from your salary or other income has actually been deposited with the Income Tax Department through Form 26AS. A friend of mine found out that his company had deducted TDS but had not deposited it – he came to know about this from Form 26AS, and he asked the company.

- Useful for ITR Filing: The information in Form 26AS helps you calculate your income and tax credits while filing your Income Tax Return (ITR). If you show incorrect income, you may get a notice from the Income Tax Department.

- Finding Discrepancies: If the information in your Form 16 (for salary) or Form 16A (for other income) does not match with the information in Form 26AS, you can contact the deductor (who deducted tax) or tax officer to get it corrected.

- Transparency: Form 26AS allows you to see all your tax-related matters at one place, which brings transparency in the tax system.

Want to cut your tax bill? 80C deductions for salaried employees!

Important to check in Form 26AS

- Compare with Form 16/16A: Check whether the TDS details in Form 26AS match your Form 16 (for salary) or Form 16A (for other income). If not, contact your deductor.

- Check high-value transactions: If you have made any big purchase (like property), then that information will appear in Form 26AS. Don’t forget to show it in your ITR, otherwise you may get a notice.

- Check refunds: If you have received a refund, it will appear in Form 26AS. Check whether it has been credited to your bank account.

FAQs:

1. What is Form 26AS and why is it important?

Form 26AS is a tax credit statement showing TDS, TCS, and advance tax details. It’s crucial for ITR filing in 2025 to verify tax deductions and avoid discrepancies.

2. How do I download Form 26AS in 2025?

Log in to the Income Tax portal (incometax.gov.in), go to e-File > View Form 26AS, redirect to TRACES, select the assessment year, and download the PDF with verification.

3. Who can download Form 26AS?

Anyone with a PAN card and TDS/TCS deductions—like salaried individuals, those earning interest, or with high-value transactions—can download Form 26AS.

4. Can I download Form 26AS through net banking?

Yes, if your PAN is linked to your bank account, log in to net banking, go to ‘Tax Services’ or ‘View Tax Credit’, select the year, and download Form 26AS.

5. What details are included in Form 26AS?

Form 26AS includes TDS on salary/interest, TCS, advance/self-assessment tax, refunds, high-value transactions, and GSTR-3B turnover data if GST-registered.